At the EDANA Outlook conference in October, 2019, you spoke of the three generations of biorefinery production. Can you briefly outline them? Biorefineries are function of the type of feedstock they are using and the process technology they deploy to transform biomass into valued-added chemicals. In terms of feedstocks, 1st Generation biorefineries use starch and sugars derived from plants. An excellent example of this is corn-based ethanol, which uses starches derived from corn to produce ethanol through fermentation of the corn-based sugars. Virtually all commercial bio-based materials, such as polylactic acid or PLA, rely on the fermentation of plant-based sugars.

In contrast, 2nd Generation biorefineries use wood, purpose-grown energy crops, such as switchgrass, and waste materials, such as straw and stover. Currently, there is considerable interest in the United States and elsewhere to use municipal solid waste or MSW to produce value-added fuels. The challenge with these materials is that they contain lignin, which is now seeing some interesting applications, such as a replacement for phenolic-based resins. Removing lignin and accessing the cellulose component of these 2nd generation has become quite a technical barrier, although considerable research efforts are on-going.

3rd Generation biorefineries are based on algal systems or look to utilize atmospheric carbon dioxide directly. These technologies are generally early-stage although there are some demonstration projects underway. In terms of benefits to the environment, 1st generation biorefineries are generally an improvement over the baseline, that is existing petroleum-derived options. For example, corn-based ethanol has about a 20-30% reduction in greenhouse gas emissions over petroleum-derived gasoline. Of course, the push-back to 1st generation biorefineries has been the fact that they may compromise the available of food resources and that they may have negative impacts from land-use, such as deforestation. Because of the choice of feedstock, 2nd generation biorefineries have greenhouse gas reduction that are great than 60% over the baseline. Whereas 3rd generation technologies, can have reductions that are greater than 100%, as they can actually sequester atmospheric carbon.

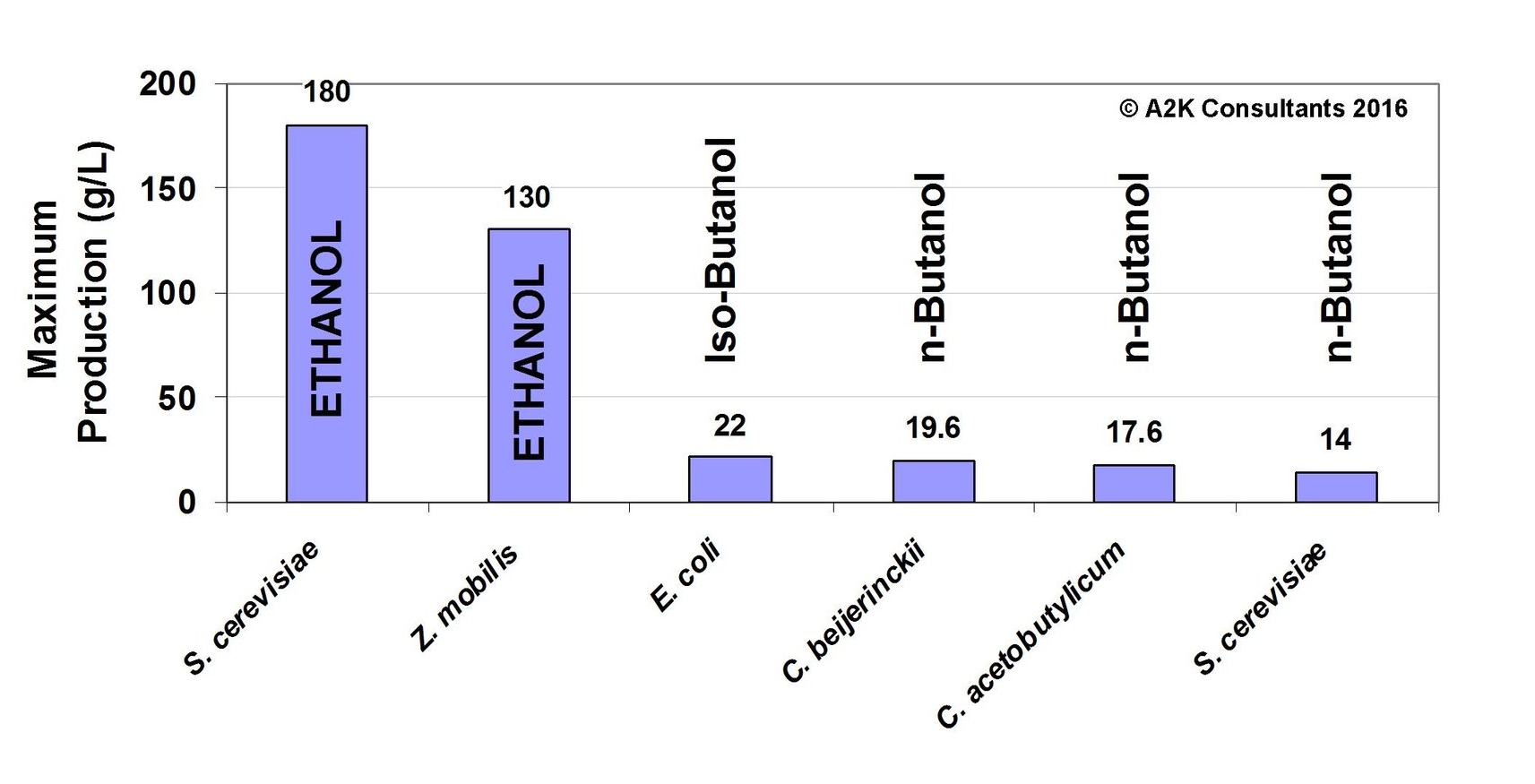

The emphasis, however, has so far been on the production of biofuels, rather than bioplastics. Why?The emphasis on biofuels rather than bioplastics is due to regulatory factors. In the United States, the Renewable Fuels Standard (RFS) sets minimum levels for bio-based ethanol and diesel fuels. A fuels identification and trading system has been developed to enable the RFS. In Europe, renewable fuel standards have also been set around atmospheric carbon dioxide emission targets, which impose taxes should these targets not be met. With clear rules of the road in place, an industry has grown. Prior to the introduction of the Energy Independence and Security Act (EISA) of 2007, which created the framework for the RFS, ethanol production in the United States was about 5 billion gallons per year. Today, it is over 16 billion gallons per year. For producers of corn-based ethanol, this has been a great success story, at least from the standpoint of capacity increases. However, there are no such drivers for the bio-plastics industry. The carbon tax, which could have been a driver for bio-plastics, has generally failed in the United States. As a result, bio-plastics must either compete with petroleum-derived plastics in terms of price and performance, or provide additional performance benefits that make it the preferred material of use. That being said, new legislative efforts, such as Single-use Plastic (SUP) bans and consumer demand for move environmentally-friendly materials should be a big driver for bio-based plastics in the future.

Yet, how successful have biorefineries for biofuels been? First generation biorefinery capacity has seen tremendous growth over the last 10 or so years, both in fuels and chemicals. On the other hand, the United States has made enormous investments in the pursuit of second-generation biofuels derived from lignocellulosic sugars, motivated by their inherently low-cost, the potential for drastically reducing carbon emissions and the promise of job creation, especially in rural communities. Unfortunately, while significant technical progress has been made, they have yet to achieve commercial viability due to their inability to compete with conventional fuels on price. However, there are a number of 2nd generation biorefinery platforms in the queue, that if successful, would transform the state of readiness for 2nd generation technologies.

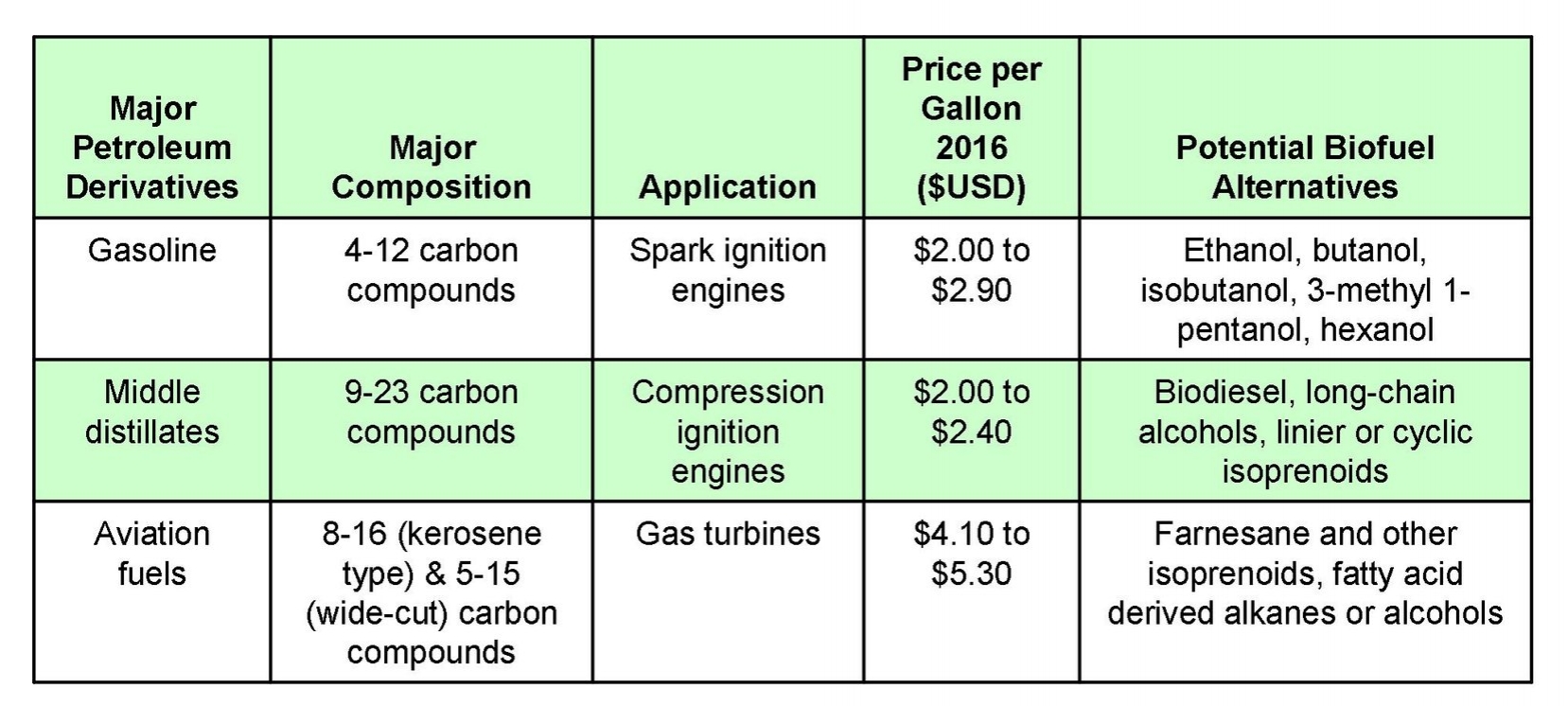

What has been the reaction to this from researchers and developers? When looking at the business case between fuels versus chemicals, clearly fuels are advantaged, especially when it comes to large-scale production platforms. As a result, considerable research has focused on the production of drop-in fuels from biomass. In terms of 2nd generation technologies, many of the demonstration projects are focusing on drop-in jet fuel replacements. The aviation industry has set a number of ambitious goals for greenhouse gas reductions, and they see bio-fuels as being part of an overall solution to this challenge.

So who is successfully manufacturing bioplastics on any kind of scale? Clearly, there are a number of very successful manufacturers of bio-plastics, both the so-called “substitute variety”, like PLA, and the “drop-in” variety, such as bio-based polyethylene (PA). The range of options, bio-based, biodegradable, compostable, is becoming very confusing, especially to consumers who are faced with responsibly disposing of these materials. From the standpoint of substitute bioplastics, starch-based materials, such as thermoplastic starch, and PLA, are proven platforms with large scale. These are success stories long in the making. Other substitutes are coming on stream but their capacity levels are low and their processes are generally unproven. On the other hand, drop-in bio-plastics represent nearly 60% of the bio-plastics market, and a number of producers for bio-based PE, polyethylene terephthalate (PET), and other commodity plastics, are on-stream and commercially available.

Do you think products containing only partial bio content, ie Coca Cola’s PETBottle, add confusion, or are they a necessary step-wise development? Use of bio-based plastics begins with a thoughtful look at strategy and deciding what problem or consumer need you are looking to solve. Using drop-in solutions, like bio-based PE, may help reduce your carbon footprint, but they won’t necessarily solve the problem of marine plastic pollution or the problem of micro-plastics in the environment. In addition, many users of bio-based plastics are not especially candid with their life cycle assessment data so can sometimes be difficult to argue the exact benefits of their solution. The confusion many of these products are adding to is at the point of recovery and recycling. For example, bio-based PET, which typically contains only 30% bio-content, disrupts the conventional PET recycling stream. Do I really want to be producing a boutique material? To my clients looking to adopt bio-based plastics, I always ask: What problem are you trying to solve?

What will it take for attention to fully move to focus on bioplastics legislation? The three big drivers for bio-plastics are legislation, consumer demand, and the response of brand owners to meet the growing demands of the both regulators and consumers. I think it’s fair to say that consumers are becoming much more aware of the health of the environment, factors effecting climate change, and the choices they are making to off-set these factors. Governments are certainly listening to their constituents and creating legislative frameworks that can achieve positive change. Perhaps, some of the global initiatives under the Paris Accords are taking a backseat because of the current political climate in the United States. However, this has not prevented countries, the European Union, and states, such as California, from taking bold stands on the environment. Since a global framework for carbon valorization has largely failed, the drivers will continue to be legislation, consumer demand, and brand owner action.

What stage do you think bioplastics will be at in five years’ time in terms of market size? Given the current level of brand-owner engagement, consumer demand, and legislative efforts, the market for bio-plastics could easily double in the next five years. The growing demand for disposable and flushable wipes, eliminating PE in all laminated foodservice applications, and single-use plastic alternatives are all low-hanging fruit for bioplastics.

And how far do you think those third generation materials will have progressed? If you include certain specialty chemicals, such as omega-3-fatty acids, in the mix of 3rd generation materials, there has been considerable progress. However, the production of commodity-type polymers and resins is still a big challenge. A number of companies are looking to capture both carbon monoxide and carbon dioxide from flue gas emissions and use this as a feedstock but these are still early-stage. There also have been a number of early stage efforts to remove atmospheric carbon dioxide and use this in a catalytic process to produce chemicals. While this is very exciting, it’s hard to imagine that these processes will be available commercially anytime soon.

© A2K Consultants 2019